top of page

.jpg)

Search

Manage Goods and Services Tax (GST) in the MoneyWorks accounting system with a non-Singapore dollar home currency

When dealing with the non-Singapore dollar (SGD) home currency in an accounting system, the GST submission to the IRAS has to be SGD.

EH Lim

Jan 22, 20242 min read

38 views

0 comments

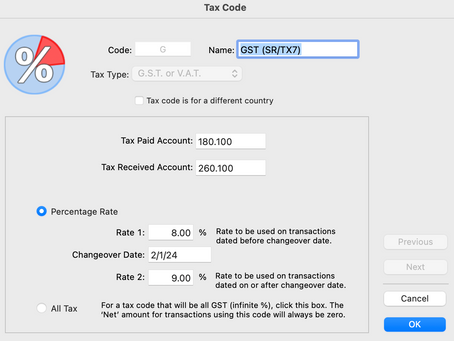

Preparing for the Switch: How to Update Your MoneyWorks Accounting System for the New GST Rate of 9%

Singapore's GST rate is to increase from 8 to 9% from 1 Jan 2024. Update the MoneyWorks accounting software to reflect the new rate to...

EH Lim

Dec 18, 20231 min read

14 views

0 comments

MoneyWorks 9.1.1 release incorporated the new requirement for GST reporting

MoneyWorks 9.1.1 release incorporated the new requirement for GST reporting

EH Lim

Dec 25, 20221 min read

7 views

0 comments

Submit GST Form 5 to IRAS from the MoneyWorks accounting system digitally

Submit GST Form 5 to IRAS from the MoneyWorks accounting system digitally.

EH Lim

Jul 14, 20221 min read

28 views

0 comments

MoneyWorks version 9.0.9r2 update

Update your MoneyWorks version 9 to the latest 9.0.9r2 before printing your GST Form 5 guide!

EH Lim

Jul 5, 20221 min read

9 views

0 comments

How to change the tax code (GST code) in a transaction?

The GST code used in the MoneyWorks transaction follows the GST code set in the account used.

EH Lim

May 19, 20222 min read

23 views

0 comments

How to change the tax rate in MoneyWorks when the GST rate increase from 7% to 8%?

The standard rated GST set in MoneyWorks is 7%, pre-loaded when you first created the company file with localisation setup as Singapore

EH Lim

Mar 4, 20222 min read

63 views

0 comments

MoneyWorks version 9.0.2

Now, you can have an option to set the GST rounding to follow the Banker's rounding method or round up to the nearest half cents.

EH Lim

Jul 27, 20211 min read

10 views

0 comments

GST on imported goods

The Customs (or the forwarder may pay on your half) will impose the GST on the imported goods when goods arrived in Singapore.

EH Lim

Mar 30, 20211 min read

63 views

0 comments

Amending GST amount on Purchase Invoice

There are two methods of computing the GST on Tax Invoice when the invoice contains more than one item with the standard rated supplies....

EH Lim

Feb 25, 20201 min read

18 views

0 comments

bottom of page