How to enter Landing costs in MoneyWorks accounting software?

- EH Lim

- Apr 4, 2023

- 4 min read

What is Landed Cost?

Landed Costs are costs incurred in shipping the product, such as insurance, customs duties, demurrage fees, etc. FedEx's website gives a detailed explanation of Landing Costs.

The objective of calculating the landing cost is to derive a "more accurate" product costing and margin (or commission calculation).

How to add a landing cost to the product cost?

**To simplify the process, we remove the GST component in this illustration.

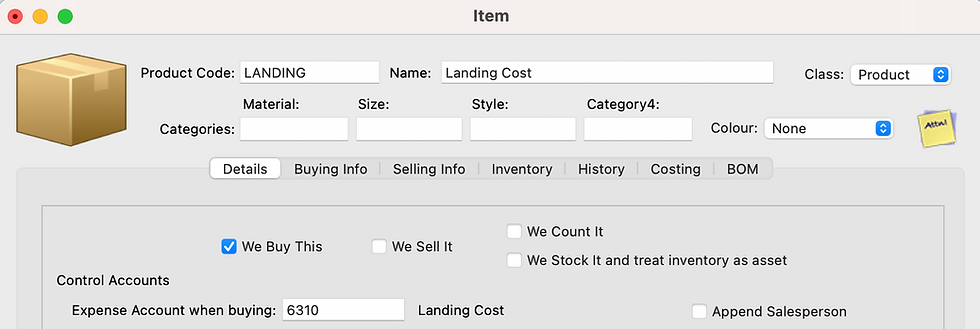

Landing item

First, you need to create a Landing item (a product item) and link it to the Landing Cost ledger account to use it as a balancing account in the purchase invoice to revert the amount owing to the supplier when inflated the product cost.

Single-Product

Assume you purchased 100 units of product P101 at $100 each with a landing cost of $1,000.

Select the product (Product P101), and enter the quantity (100 units) and the unit price of $100 into the first row (in the item tab) of the purchase invoice. MoneyWorks calculate and update $10,000 (100 x $100) in the Extension (amount) field.

Next, amend the Extension from $10,000 to $11,000 ($10,000 product value + landing cost of $1000). Due to the Extension being different from the original value ($10,000), "-10" (negative 10%) is inserted automatically in the Disc % (Discount) field.

The amount owing to the supplier is $10,000; therefore, add a Landing item to the purchase invoice with a negative value of $1,000 (-$1000) to revert the gross amount owed.

The transaction gross (total outstanding) now reverted to $10,000 ($11,000 - $1,000).

The journal behind the Purchase Invoice:

DR. Inventory Assets (BS): $11,000

CR. Landing Cost (PL): $1,000

CR. Accounts Payable (BS): $10,000

And the average unit cost of P101 increased from $100 to $110 per unit.

Note:

The product cost has already contained the landing cost, which will debit to the Cost of Goods Sold once sold. Debit the Landing cost ledger when receiving the actual bill (or payment) from the respective vendor (or agency) of those landing costs incurred.

Multiple-Products

It gets complicated when allocating the landing costs to multiple products; to simplify the calculation, we may base it on the total value of each product instead.

Let's say we shipped in three products with a $3,000 landing cost:

100 units of Product P101 at $100 each (total of $10,000)

200 units of Product P202 at $100 each (total of $20,000)

100 units of Product P303 at $200 each (total of $20,000)

Based on product value, the landing cost allocation will be:

(Landing cost / total cost of all products) x total value of each product

Product P101: $600 (3000/50,000 x 10,000)

Product P202: $1,200 (3000/50,000 x 20,000)

Product P303: $1,200 (3000/50,000 x 20,000)

Use the same entry method as the single-product; enter the Purchase Invoice with the amount inclusive of the landing cost. For example, enter the amount of product P101 as $10,600 ($10,000 + $600 landing cost) instead of the original $10,000 (100 units x $100 each), and the discount field will auto-calculate at -6%.

Then, add the landing cost with a negative amount (-$3,000) to revert the inflated purchase invoice to the original owing ($50,000).

Manual but workable if you do not have many items in a single invoice or lots of transactions that require calculating the landing cost. It will be taxing if most of your purchases are from overseas.

Can this be automated?

Landing Costs Script

Consider using the free landing cost script developed by Cognito, which comes with the MoneyWorks sample file (Acme Widget Ltd), if manually calculating and allocating the landing cost to each product is taxing to you.

What is a script?

A Script is a program (sub-function) enhancing the MoneyWorks core modules. For example, you may add a Landing cost script to automate the cost calculation, add extra columns into the detail window of the transaction to facilitate HS Code or Country of Origin entry, or a script to load the last sell price of a product when issuing an invoice to a customer. Scripting is a powerful feature in MoneyWorks. Programmers may refer to the MoneyWorks Guide if interested in developing a script to enhance MoneyWorks accounting software.

How to add the landing cost script to your company file?

Open the sample file, Acme Widgets Ltd, go to the Show menu and select Scripts to launch the script window. Then, highlight the "Apply_Landing_Cost" script (on the left panel) and select the "Save selected script as XML" option from the Gear icon at the bottom of the window.

Next, launch your company file and double-click on the saved Apply_Landing_Cost script to install the script onto your file.

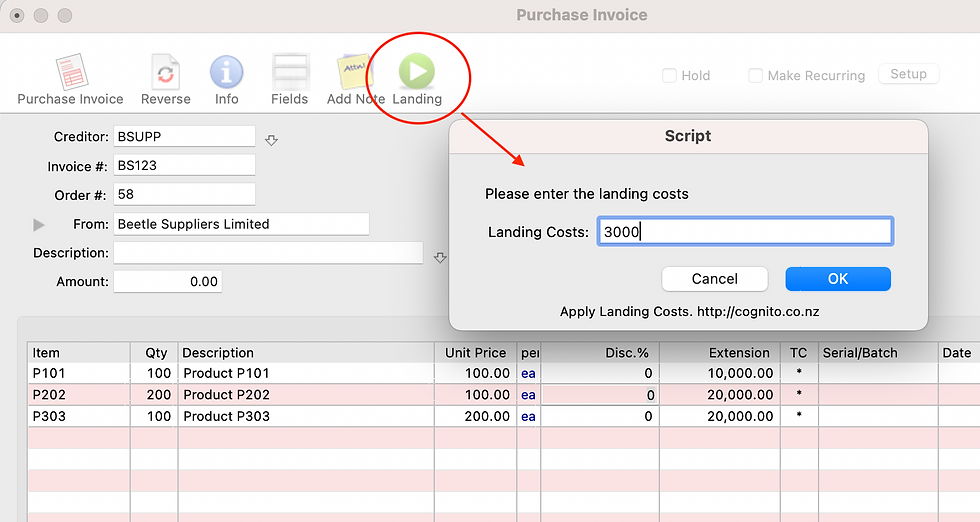

How to use the Apply_Landing_Cost script?

Let's base on the same example above:

Shipped in three products with a $3,000 landing cost.

100 units of Product P101 at $100 each (total of $10,000)

200 units of Product P202 at $100 each (total of $20,000)

100 units of Product P303 at $200 each (total of $20,000)

Assuming you have already added the landing cost item (item code: LANDING) and linked it to the landing cost expense account (or Cost of Goods Sold).

Enter the purchase invoice with the three products according to the bill without inflating the cost (i.e. $10,000, $20,000, and $20,000).

Then, click on the Landing icon (a new icon added by the landing cost script) at the top of the Purchase Invoice window, enter the landing cost (e.g. $3000) in the pop-up window and save your entry.

The landing cost script automatically adds the Landing item to the Purchase Invoice with a negative landing cost (-$3000) which you have entered and apportions the cost among the products.

That's it.

Now, apportion of landing costs is automated based on the product value.

Book an online demonstration to learn more about MoneyWorks accounting software.

.jpg)

Comments